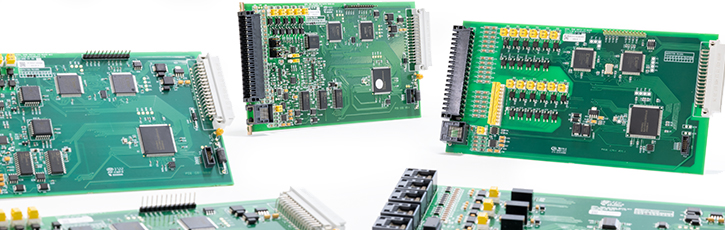

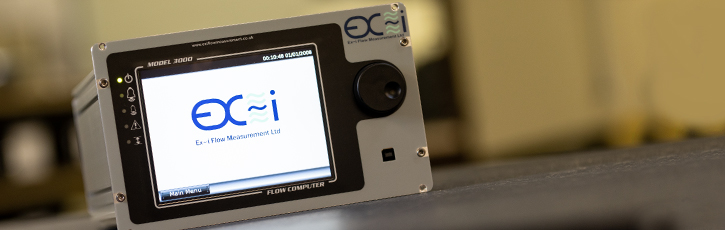

Mk2 Option Boards for SFC3000

Posted onDue to the ever-changing silicon market, we have needed to redesign the SFC3000 option boards. Each option board has a “Mk2” version – functionally the same from the outside of the flow computer, but uses an ARM processor to replace the Motorola. Alongside this revised processor, some of peripheral components have also been changed, either […]